Sinking fund depreciation calculator

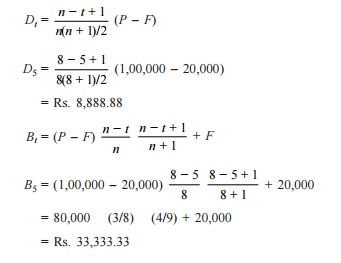

The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. D P - A.

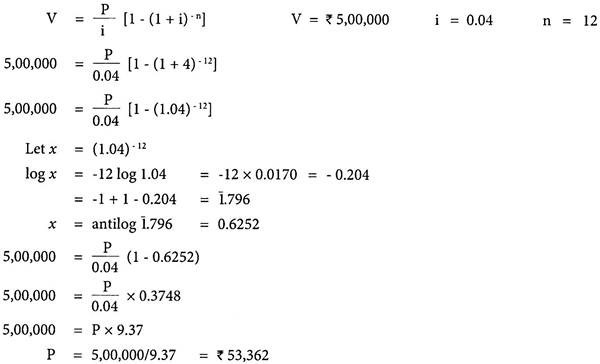

Time Value Of Money Board Of Equalization

Here we discuss How to straight Line Depreciation along with practical examples.

. This has been a guide to the Straight Line Depreciation formula. The Car Depreciation Calculator uses the following formulae. We also provide a Straight Line Depreciation Calculator with a downloadable excel template.

The average car depreciation rate is 14. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. You may also look at the following articles to learn more Calculator for Net Interest Margin.

Section 179 Deduction Calculator. A P 1 - R100 n.

Salvage Value Formula Calculator Excel Template

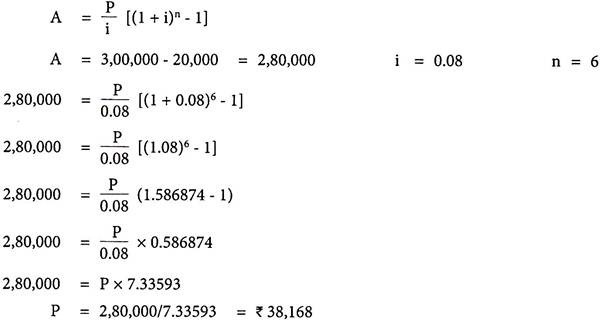

Calculation Of Amortisation And Sinking Fund Firm Financial Management

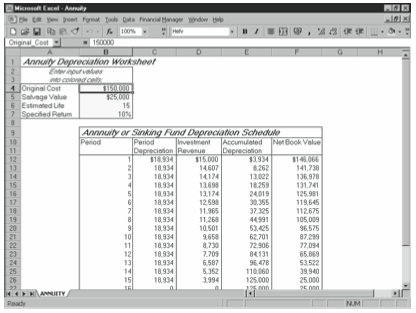

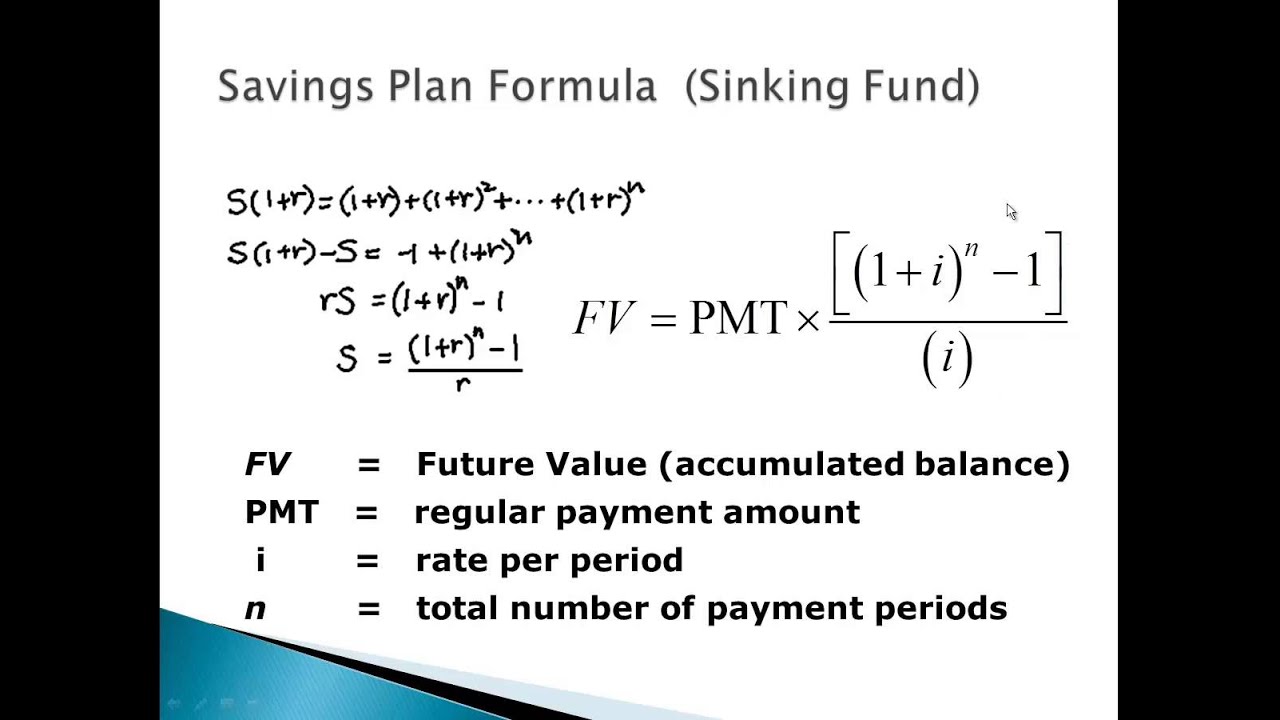

Understanding The Annuity Or Sinking Fund Depreciation Starter Workbook Stephen L Nelson

Sinking Fund Method For Calculating Depreciation Qs Study

Sinking Fund Depreciation Method Calculator

Solution Calculate The Annual Depreciation Cost By Sinking Fund Method At 4 Interest

Lesson 13 2 Sinking Fund Method Sfm Depreciation Methods Engineering Economy Youtube

Depreciation Formula Examples With Excel Template

Lesson 13 2 Sinking Fund Method Sfm Depreciation Methods Engineering Economy Youtube

Sinking Fund Method Definition Functions Formula Benefits

Salvage Value Formula Calculator Excel Template

Methods Of Depreciation

Sinking Fund Method Of Depreciation Example Tutor S Tips

Cash Flow To Debt Service Ratio Accounting Education

Economics Of Power Generation Part 2 Electricaleasy Com

Calculation Of Amortisation And Sinking Fund Firm Financial Management

Introduction To Sinking Funds Youtube